Major producing regions include Texas, Louisiana, Arkansas, Pennsylvania, West Virginia, Ohio, and North Dakota. Additional resource potential exists in California and Colorado as well as other states.

|

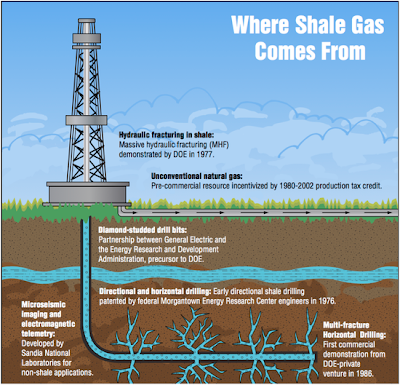

| Source: www.thebreakthrough.org |

At any particular shale gas development project site, the primary shale gas resource annual average throughput production is subject to the number of vertical wells and corresponding multiple horizontal wells drilled at each specific wellhead location.

Overall production output from each vertical well is directly dependent upon each corresponding horizontal well(s) production output in terms of estimated ultimate recovery (EUR), initial gas production rates and actual decline rates over the economic life cycle of each particular well. In order to maintain sustainable shale gas production profile on a continual basis, periodic hydraulic fracturing may be required for steady-state volumetric throughput regeneration while unlocking trapped gas reserves from various geologic formations.

The wellhead gas composition consists of various fractions, mainly methane or "natural gas" as well as smaller percentages of ethane, propane, and traces of other of heavier alkanes such as butane and pentane. Typically, separation of methane from the heavier alkanes is achieved through the use of pre-engineered and packaged cryogenic expansion turbine equipment systems. The heavier components from the "cryo-plant" are stored on-site and subsequently exported as by-product natural gas liquids (NGLs) via truck, rail or pipeline depending on the specific location and accessibility to commercial petrochemical markets.

The entire shale gas value chain consists of production-transmission and distribution. The above-ground infrastructure covers gas gathering and processing facilities and pipelines systems interconnecting various production wellheads.

The produced gas must be further separated, dehydrated, treated, processed, compressed, and metered prior to being sent-out through a intra-state and interstate pipeline transmission system to either wholesale and/or retail consumers. Along the value chain of production-transmission-distribution, significant capital expenditure (CAPEX) and operating expenditure (OPEX) is required covering various capital equipment, products and services as well as equity / debt financing and working capital requirements.

The multitude of market influencing factors impacting U.S. shale gas include, but not limited to, technical feasibility, federal / state regulatory policy and framework, permits & clearances, environmental advocacy, demand elasticity (subject to wellhead / burner-tip price, commodity indexation, and consumer credit-worthiness), competing alternate fuels (coal, crude oil, nuclear, imported LNG, hydroelectric, and alternative / renewable energy), capital formation, structured project financing and associated technical-commercial risks.

In coming years, it will be important to closely monitor and evaluate the various factors influencing the outlook for the U.S. shale gas industry. In addition, it remains to be seen whether the bipartisan "Natural Gas Act" or "NATGAS Act", pending legislation in the U.S. Congress for several years, will ever be formally enacted. There are also some natural gas industry proponents actively promoting the conversion of the existing LNG import terminals into possible export LNG terminals for sale of U.S. shale gas production to overseas customers.

References:

1. http://www.eia.gov/energy_in_brief/article/about_shale_gas.cfm

2. http://en.wikipedia.org/wiki/Shale_gas_in_the_United_States

3. http://www.api.org/policy-and-issues/policy-items/exploration/facts_about_shale_gas

4. http://www.pwc.com/us/en/industrial-products/publications/shale-gas.jhtml

No comments:

Post a Comment